From Physical Markets to Verified Platforms: How UAE Is Modernising Spare Parts

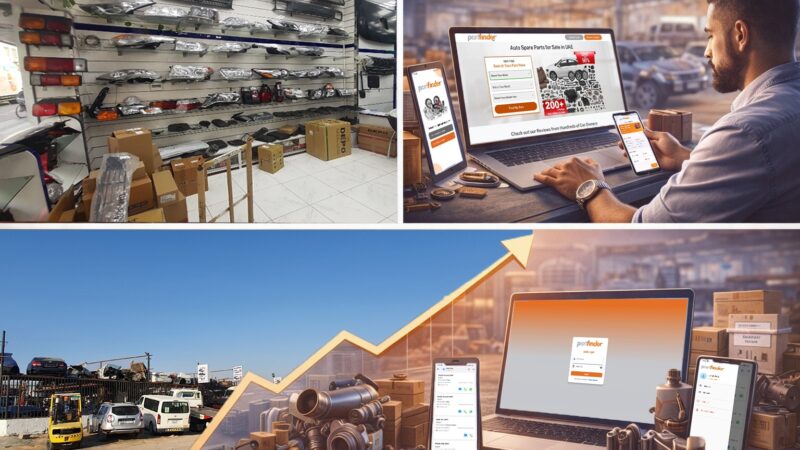

From Dubai’s traditional markets to digital verification, the UAE is modernising spare parts sourcing through transparency, process, and accountability at scale.

For decades, spare parts sourcing across the UAE followed a familiar rhythm. A trusted contact, a quick drive to the market, a glance at the part, a negotiation, and the job moved forward. In places like Dubai and Sharjah, physical markets became an efficient backbone for workshops and owners alike – fast, relationship-led, and often surprisingly effective.

But the region’s automotive reality has shifted. Vehicles are more complex, buyers are more time-poor, and cross-border demand is more common than ever. The spare parts trade is not disappearing – it is evolving. The modernisation underway is less about “moving online” and more about moving to verification, accuracy, and accountability.

In short: the UAE is moving from physical markets to verified platforms.

The physical market still wins on speed, but not always on certainty

Physical markets offer something digital cannot replicate: immediacy. If you know the lanes, the sellers, and the rhythm of the market, you can often source a part quickly – especially for high-volume models. For workshops, that speed means reduced downtime and satisfied customers.

However, physical sourcing also has limits that become clearer as vehicles become more specialised:

- Inventory is localised to one city or one market

- Buyers depend on personal inspection and experience

- Part variants are easier to miss under time pressure

- The process is difficult to scale across Emirates and borders

For modern cars – particularly premium vehicles – those limits matter.

Modern vehicles have made “close enough” too expensive

Two cars with the same model name can require different parts due to trim levels, drivetrain variants, mid-year production changes, and regional specifications. In premium cars, a small mismatch can cause warning lights, calibration issues, or a part that physically fits but fails electronically.

This is why the old confidence of “it should work” is less reliable now. The cost of being wrong is higher:

- Wasted labour

- Delayed repair timelines

- Return disputes

- Repeat breakdowns

- Additional damage when incorrect parts are fitted

As a result, accuracy is becoming the new currency of the spare parts trade.

Cross-border sourcing is now routine, not rare

Another driver of modernisation is the growing normality of cross-border sourcing. A part might be scarce in one market and available in another. Workshops and owners increasingly source based on availability rather than geography – especially when turnaround time matters.

This is where physical markets hit a practical barrier: travel time, coordination, and uncertainty add friction. Digital sourcing removes some of that friction, but only when it is structured and verifiable.

“Online” is not automatically safer – verification is the real shift

The UAE’s spare parts market has seen plenty of basic online selling: single-seller websites, classified-style listings, and social media deal-making. Those channels can be convenient, but they also increase risk when seller identity is unclear and part descriptions are vague.

Verified platforms take a different approach. The value is not simply that the transaction happens online – it is that the process becomes structured and accountable.

A verified model typically includes:

- Clearer seller identity and traceable contact details

- Consistent part condition labelling (genuine, used, aftermarket)

- VIN-led compatibility checks to reduce mismatch risk

- Real photos and documented communication

- Quote comparison that gives buyers price context

- A workflow approach: enquiry → verification → quote → confirmation

This structure reduces the two problems that cause most friction in spare parts buying: wrong parts and uncertain sellers.

Why verification matters more for premium ownership

Luxury and performance vehicles amplify the consequences of poor sourcing. Electronics and safety systems are less forgiving. A part that is “almost right” can still cause problems – especially with sensors, modules, and integrated systems.

For owners of premium vehicles, the priority is often not the lowest price. It is:

- Correct fit and function the first time

- Reduced downtime

- Confident sourcing for safety-related parts

- Documentation that supports resale value and maintenance history

Verified sourcing aligns with that mindset. It turns the parts hunt into a controlled process rather than a gamble.

Sellers are modernising too: from footfall to funnel

This shift is not only a buyer story. Sellers benefit when the market becomes more structured.

In a traditional physical market, sellers depend heavily on footfall, repeat relationships, and proximity. Verified platforms expand reach beyond one location and make enquiries more targeted.

For sellers, modernisation can mean:

- Fewer irrelevant enquiries (because buyers submit clearer vehicle details)

- Faster conversions through direct communication and documented quotes

- The ability to serve customers across multiple Emirates and neighbouring markets

- Better predictability: a pipeline of enquiries rather than occasional walk-ins

The strongest sellers in the region are not replacing the physical market – they are extending it digitally.

Price transparency is reshaping buyer behaviour

One of the most noticeable changes in the platform era is how buyers interpret price. In physical markets, buyers often see only the quote in front of them. In verified digital environments, buyers can compare multiple quotes quickly.

That comparison creates a healthier market dynamic:

- It exposes specification mismatches (cheap quotes often reflect different variants)

- It reduces overpricing for common items

- It helps buyers understand the genuine-vs-aftermarket trade-off

- It pushes sellers to compete on service and speed, not just price

Transparency does not eliminate pricing differences – but it makes them easier to understand.

The hybrid future: physical markets plus verified platforms

The next phase in the UAE will not be a simple replacement of physical markets. The likely future is hybrid:

- Physical markets remain a vital inventory hub

- Verified platforms become the discovery, verification, and communication layer

- Logistics and delivery close the gap between location and customer

In this model, the market’s strength becomes accessibility, while the platform’s strength becomes certainty.

For buyers, it means fewer wrong orders and less wasted time. For sellers, it means broader reach without losing the advantages of local stock.

A practical takeaway for owners and workshops

“In today’s UAE spare parts market, speed matters — but verification matters more. VIN-first matching, real photos, and traceable communication are what reduce costly wrong-part orders.” — Muzam Rashid, Co-founder, Partfinder UAE

For buyers, the safest habit is simple: verify before you pay. VIN-led matching, real photos, clear condition, and traceable communication reduce almost every major risk.

For workshops, the competitive edge is speed with accuracy. Wrong parts are not just an inconvenience – they are lost labour and delayed bays. A verified sourcing workflow protects margins and reputation.

A useful example of this approach is using a verified auto spare parts marketplace such as Partfinder UAE, where buyers can request quotes from verified sellers and confirm compatibility before purchase.

Conclusion

The UAE spare parts market is not abandoning its roots. It is modernising them.

Physical markets built the region’s advantage through inventory density and relationships. Verified platforms are building the next advantage: accuracy, accountability, and scale. As vehicles become more complex and buyers value time as much as price, the winners will be the ecosystems that combine speed with certainty.

That is what modern spare parts sourcing in the UAE is becoming: less hunting, more process – and far fewer mistakes.

Subtle backlink placement (editor-friendly)

Anchor text: verified spare parts marketplace

Suggested placement line: “A useful example of this approach is using a verified spare parts marketplace such as Partfinder UAE…”